In April 2016, China’s traditionally peak

sales season for phosphate fertilizers in spring is basically over. In the

following quarter when the slack season comes, the domestic phosphate

fertilizer industry will turn to the export market. However, influenced by the

high export volume in 2015, demand from the international market is very

limited. Thus, it is predicted that the export market in Q2 2016 will be

stagnant.

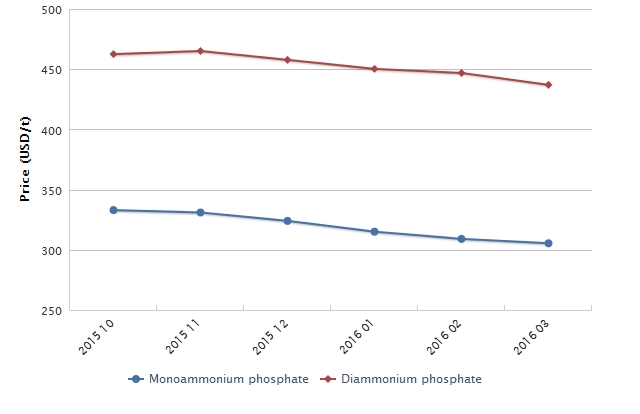

Ex-works price of MAP and DAP in China,

Oct. 2015–March 2016

Note: MAP stands for monoammonium

phosphate;

DAP stands for diammonium

phosphate

Source: CCM

In April 2016, China’s traditionally peak sales season for phosphate fertilizers

in spring is basically over. Only a few areas have demand for fertilizers and

trading volume of diammonium phosphate (DAP) is shrinking sharply.

Meanwhile, compound fertilizer manufacturers begin to turn to producing

high-nitrogen fertilizers instead, leading to a sharp decline in demand for

monoammonium phosphate (MAP). As a result, many MAP manufacturers are forced to

reduce their operating rates and those who stopped production before put off

their production resumption plans.

So currently, some domestic MAP and DAP manufacturers have already begun to

suspend production while those who are maintaining operating levels lay their

emphasis on the export market.

However, influenced by the high export volume of phosphate fertilizers in 2015,

demand from the international market is very limited and market prices remain

at low levels. Thus, CCM predicts that the export market in the second quarter

of 2016 (Q2 2016) will be stagnant and this will hamper the development of the

China’s phosphate fertilizer industry.

In recent years, market dynamics of the export market has become the wind vane

for China's phosphate fertilizer industry, even for the whole chemical

fertilizer industry. For example, market conditions of the phosphate fertilizer

industry were closely connected to the export market in 2015. In detail, in the

first three quarters of 2015, output and price of phosphate fertilizers were

increased YoY boosted by the prosperous export market while in the fourth

quarter, as demand from the international market decreased, China's phosphate

fertilizer industry collapsed sharply and this situation has lasted till now.

In 2015, China exported 8.02 million tonnes of DAP and 2.74 million tonnes of

MAP, growing by 64% and 18% YoY respectively. In addition, the average export

price also increased slightly YoY.

Behind the increasing export volume and price, it was the increasing demand

from the international market boosted by concentrated purchase and the China's

adjustment to the tariff policy.

Since Jan. 2015, China began to implement the same tariff policy for phosphate

fertilizers in both peak season and slack season, lowering the overall export

tariff for manufacturers which improved their competitiveness in the

international market.

High export volume in 2015 brought considerable profits to domestic phosphate

manufacturers. Yet, on the other hand, it exerts pressures on these

manufacturers in exports in 2016. In the first quarter of 2016, high level of

inventory led to a stagnant demand for phosphate fertilizers in the

international market and China's export price of this product kept dropping.

Though the international demand is expected to recover to some extent in the

second quarter, it is less likely for China's export price to increase

according to the current market conditions. Insiders disclosed that China's DAP

is mainly exported to India. However, with an existing inventory of nearly 1

million tonnes and its import subsidy being cut by about 33%, Indian purchasers

put pressures on exporters to lower their prices (to about USD340-345/t).

Besides this, though Brazil increased its import volume of MAP recently, its

total purchase volume was reduced YoY due to its adjustment to crop planting.

According to CCM, factors that will influence China’s phosphate fertilizer

market in the whole of 2016 include:

1. Decreasing price of agricultural produce

The agricultural means of production industry expects unsatisfactory market

demand in 2016. Without external stimulation from favorable subsidy policies,

the agricultural industry is not likely to recover in the short term.

2. Depressed international market

China’s main export destinations for phosphate fertilizers are all have high

level of inventories which are not likely to be swallowed in the short term. In

addition, the decreasing grain prices lead to a limited market demand and

importers are putting pressures on exporters to lower their product prices.

Thus, the total export volume of phosphate fertilizers in 2016 will be

significantly decreased compared to that in 2015.

3. Severe overcapacity

As trading is lax, how to sallow capacity has become a tough problem for

phosphate fertilizer manufacturers. CCM predicts that successive manufacturers

will suspend production and promote sales by lowering product prices in the

near future.

4. Falling price of raw materials

Market prices of raw materials including sulphur, pyrite, phosphorus ore and

synthesis ammonia are still in a downturn and fail to support the phosphate

fertilizer market.

*This article comes from Phosphorus Industry China Monthly Report 1604 , CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag:phosphate fertilizer